Beware 1 setback of Mortgage Reducing Term Assurance

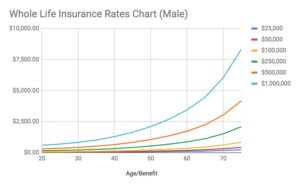

One alternative to mortgage-reducing term assurance (MRTA) is mortgage-level term assurance (MLTA). MLTA is a whole life insurance policy that provides coverage for the full duration of the mortgage term. Unlike MRTA, the coverage amount remains constant throughout the policy term, which may provide more financial security for the insured and their loved ones.

MLTA is typically sold by mortgage brokers, insurance agents, or bankers as an alternative to MRTA. It offers a broader range of benefits and flexibility compared to MRTA, including potential cash value accumulation and the ability to use the policy for other purposes, such as income replacement or estate planning.

It’s important to note that MLTA may have higher premiums compared to MRTA due to the longer coverage period and potential cash value accumulation1. The suitability of MLTA as an alternative to MRTA will depend on individual circumstances and needs. Consulting with a financial advisor or insurance professional can provide personalized guidance based on specific requirements.

Beware 1 setback of Mortgage Reducing Term Assurance

Mortgage-reducing term assurance (MRTA) is a type of insurance that is specifically designed to cover a decreasing mortgage balance over time. Here are some pros and cons of mortgage reducing term assurance:

Pros:

- Cost-effective: MRTA is generally more affordable compared to other types of mortgage insurance1. Since the coverage amount decreases over time as the mortgage balance reduces, the premiums are usually lower.

- Simplified underwriting: MRTA policies typically have simplified underwriting processes, making it easier to obtain coverage compared to other types of insurance.

- Tailored coverage: MRTA policies are designed to align with the decreasing mortgage balance, ensuring that the coverage amount remains appropriate throughout the loan term.

- Peace of mind: Having MRTA can provide peace of mind, knowing that your mortgage balance will be covered in the event of death or disability.

Cons:

- Coverage reduction: As the mortgage balance decreases, the coverage amount also decreases over time. This means that towards the end of the loan term, the coverage may not be sufficient to fully pay off the remaining mortgage balance.

- Limited coverage: MRTA only provides coverage for the mortgage balance and does not offer additional benefits such as investment or cash value accumulation.

- Non-transferable: MRTA policies are tied to a specific mortgage and are non-transferable. If you refinance or sell your home, you may need to obtain a new policy.

- Temporary coverage: MRTA policies typically have a fixed term, which means that coverage will end after a specified period. If you still have a mortgage balance at the end of the term, you will need to seek alternative coverage.

It’s important to evaluate your specific needs and circumstances before deciding whether mortgage-reducing term assurance is the right type of insurance for you. Consider speaking with a financial advisor or insurance professional who can provide personalized advice based on your situation.

Beware 1 setback of Mortgage Reducing Term Assurance

Investment Link and Mortgage Reducing Term Assurance are two different financial products with distinct purposes.

Investment Link is a type of investment product that allows you to invest your money in various investment options such as stocks, bonds, and mutual funds. The returns on your investment are dependent on the performance of these investments and can provide potential growth over time. This type of product is typically used to build wealth and accumulate savings for the long term.

On the other hand, Mortgage Reducing Term Assurance (MRTA) is a type of life insurance policy specifically designed to cover the outstanding amount of a mortgage loan. In the event of your death, the policy pays out a lump sum to the lender, reducing or fully eliminating the outstanding mortgage balance. The purpose of MRTA is to provide financial protection to your family and loved ones by ensuring that they won’t be burdened with repaying the mortgage in the event of your passing.

In summary, the Investment Link is for investment purposes, aiming to grow your wealth over time, while Mortgage Reducing Term Assurance is a life insurance policy that covers your mortgage loan, providing financial protection to your beneficiaries. Both products serve different purposes, and it’s important to assess your needs and financial goals before deciding which one is more suitable for you.

Beware 1 setback of Mortgage Reducing Term Assurance

One option to protect your housing loan if you are unable to work due to illness is to consider mortgage disability insurance. Mortgage disability insurance is a type of insurance that can cover some or all of your mortgage payments in the event that you can’t work due to illness or injury. This insurance policy provides a benefit specifically for your mortgage payments and can help ease the financial burden of your housing loan while you are unable to work.

Mortgage disability insurance works similarly to regular long-term disability insurance, but it specifically focuses on covering your mortgage payments during your period of disability. It does not pay a percentage of your pre-disability income like regular disability insurance would.

The cost of mortgage disability insurance will depend on various factors such as the remaining balance of your mortgage loan and the length of your loan term. It’s important to note that the cost of the insurance policy will typically be a monthly premium that you will need to pay.

In addition to mortgage disability insurance, it’s also recommended to be proactive in managing your finances and creating a plan to ensure you can pay your bills while you are unable to work. This may involve creating a bare-bones budget and considering other strategies to help ease the financial impact of your disability or illness.

Remember, it’s essential to carefully assess your financial situation and consider consulting with an insurance professional to determine the best option for protecting your housing loan in case of inability to work due to illness.

In order to cover illness and build cash value for your housing loan, there are a few insurance options to consider:

- Mortgage Protection Insurance: Mortgage protection insurance is designed to provide coverage for your mortgage payments in the event of illness or disability that prevents you from working. It can help ensure that your mortgage payments are covered, and your home is protected.

- Life Insurance with Cash Value: Another option is to consider a life insurance policy with a cash value component. Certain types of life insurance, such as whole life or universal life insurance, can build cash value over time. This cash value can be accessed in the future to supplement your income or cover your housing loan payments in case of illness.

- Critical Illness Insurance: Critical illness insurance provides a lump sum payment if you are diagnosed with a critical illness covered by the policy. This payment can be used to cover your housing loan payments or any other financial obligations you may have while dealing with the illness.

It is important to carefully review the terms and conditions, coverage limits, and exclusions of any insurance policy before making a decision. Additionally, consulting with a financial advisor or insurance professional can help you determine the best options based on your specific needs and circumstances.

Note: The above information is a general overview and not personalized financial advice. Please consult with a financial professional for advice tailored to your specific situation.