Independent Agent or Bank Provides Better Claim Service. What is that to compare? Most public with the herd mentality would agree that the bank would provide better claim service comparing the independent agent.

In my course of handling any claim and servicing my client, I have come across three incidents that bank taking the insured for granted for yearly auto direct with the insurance renewal.

Malicious damage

One of my friend who runs a plastic product manufacturing factory. He called me that his factory some of the semi-transparent plastic ceilings haves been vandalous by a group of restless lad who lives nearby. I advised him to inform that bank since the factory was mortgaged to the bank for securing a loan facility.

” Sorry sir, you can claim for the fire that burnt down the building structure, you cannot claim for roof damage due to vandalism”

To my horror, the strike riot and malicious damage clause are added in the special peril fire insurance policy.

My friend was damned mad with the bank reply. Next year, he renewed factory fire insurance with me until today.

Lightning Damage Television

My elder sister called me one day, there was a surge of electricity that prised open the wall during thunder. Her dementia husband forgotten to switch off the switch. The cracked on the wall was visibly quite severe as it followed the wiring line that that from outside TV antenna. It costs about a few thousand ringgits to reinstate back the cracked open wall.

The next day, I went personally make a report to the bank staff that in charge of insurance that I want to claim lighting damage.

” Please call the HQ and here is the telephone line.”

“Sir, you have to obtain a meteorology report that there were lighting and thunder striking that area. Your sister’s daughters are co-owner of the house need to come to Kuala Lumpur to file the claim.”

Forgo the Claim

One of the daughters was working in Hong Kong and another at Kajang. After considering so much travel expenses involving and time-consuming. We finally forgo the claim. ( At that time, I was a greenhorn when dealing with insurance, only passing the PCE examination, someone called a kindergarten qualification).

Sewing Machine Damage

Batu Pahat is full of the textile factory that gives rise to the subsidiary industry. Garment manufacturing is one of the labor intensive industry. The manufacturer often subs it to other small garments factory to sew bulk order receiving from the oversea buyers like Lady Bird, Cheetah, Levis Jean. There is a mushroom of such factory in the rural area to enjoy the plentily of labor, cheap rental, and other overhead expenses.

Brother industrial brand sewing a prefer choice to the factory. The small scale with less than 100 sewing machines needs to have a fire insurance within the air-conditioned building. Lighting is very common to strike on such building. It is a frequent phenomenon it caused damage to the sewing machine.

” Why the banker insurance rejects my claim for the lighting damage to my plant and machinery? the boss lady asked me.

” How often” I probing further.

” Ten years 3 times, even though my total of claim is merely less than Rm20,000. Three times the same answer”

“No claim unless fire damages your machinery.”

I handle her factory insurances for the past 10 years ever with 2 minor claims. Her 3-year sewing machines were new for old reinstatement basic.

Banker or Insurance Agent/Broker

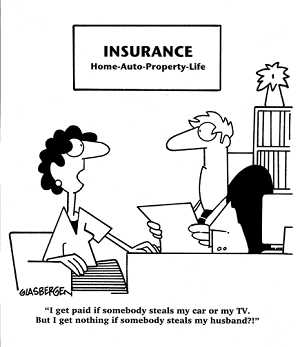

Do you think bank provides better service than the insurance quality agent/broker during the time of a claim?

If you like my article.

Please share it out with your friend or family member. Sharing is joy doubles. I welcome any suggestion and comment or be a subscriber to my mailing list.

Email me at [email protected].

Thanks

![]()