Insured Need a Quality Insurance Agent/Broker.

Why an insured needs a professional, ethical, knowledgeable quality insurance agent/broker? Up the wall when an invisible agent when a claim occurs, instead of lending a hand to handle the claim when an insurer denies liability giving reason only up to them to understand. The agent washed their hand off in the crisis juncture. The frantic insured had nowhere to turn to except engaging a legal assistant which can avoid. A tailor-made policy is a win-win for the agent and the insured based on the latter’s need.

2 different agents, 2 clients, Same Insurer

Stumbling across during my earlier years in the general insurance industry, having the same insurer, the same occupations, 2 insured with 2 different agents also have 2 different treatments during the claim.

Keen and earnest to expand my insurance business, thus I studied diligently to get my Chartered insurance qualification from the UK. Coupling with paper qualification and hands-on working experience working in a public listed establishment, easily convince the conglomerate corporation and closing exorbitant premium policy. Called it a Quality working day when you can earn $5 000.00 in commission a day why closing a $1000 policy premium.

Selection of Risk

Combing every inch, leave no stone unturned of the Johor state in marine insurance and Good in Transit policy market, there are so many factories and logistics firms need our professional services, plenty of giant fish in the ocean to catch and selecting those quality pay masters, discarding the rotten one.

One morning, I received a call from my existing customer “Mr. When are you free to drop my office, my friend needs your advice on cargo claim matter.”

” Mr. Boss, no problems, is this coming Monday morning at 10.a.m. Is it alright with you and your buddy?

Quality Agent/Broker

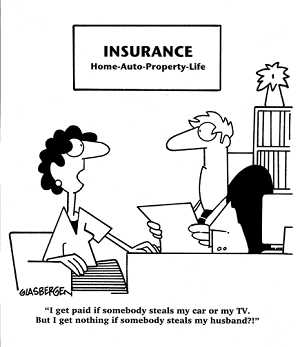

The sorrowful story when an insured having the half-baked agent to handle the insurance.

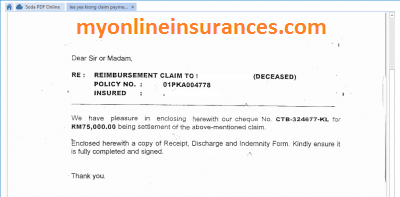

2 Various Policies Covering the same Occupation

Mr. WWW having a bigger fleet of lorry named X Company. I handled their cargo insurance for the past 3 years, for an annual premium of $18000.00 for each loss of $200 000.00 with an excess of $2 000.00. Including the armed robbery and hijacking clauses, the insurer paid the full settlement of a loss claim of $150 000 less an excess. The ill-fated lorry conveyance expensive tile had skipped out the NS highway divider, landed on the 20 feet ravine, the smashing tiles piling the monsoon drain.

His buddy Mr. YYY also running a transport company half of the fleet size comparing with Mr. WWW. A motor specialist agent closed the Good in Transit policy an annum premium of $27 000.00, a deductible of $5 000.00 for each loss valued at $50 000.00 per conveyance. One of his lorries ferrying low-end market title, a bus rammed into the back part of the lorry from behind on the NS Highway, causing the consignment a total loss without any salvage value. The insurer refused to pay him a single cent, that really puzzling after hearing his buddy successful claim on the similarity scenario.

Wrong Policy

Carefully, I scrutinize the 2 separate policies from 2 various intermediaries on the cargo insurance with the same insurer and concluding the pros and cons.

“Mr. Y, you have brought a liability policy i.e. Bailey and warehouseman policy. No doubt this policy is covering your cargo insurance. It covered damage and pilfered to the cargo under your custody in the warehouse. It does cover the good while in transit between the sellers to the buyer destination. What you need is a Good in Transit policy. Even though the same insurer issued 2 separated policy covering the same subject with a variable protection, truly apologize I can’t help you out in this matter.”

It is utmost dangerous to buy insurance from those agents who don’t understand your need.

Bank Manager does not understand insurance got burn on his finger will be the next topic.

YOU ACKNOWLEDGE MY ARTICLE.

Please share it out with your friend or family member. Sharing is joy doubles. Welcome any suggestion and comment or be a subscriber to my mailing list.

Email me at [email protected].

Thank.