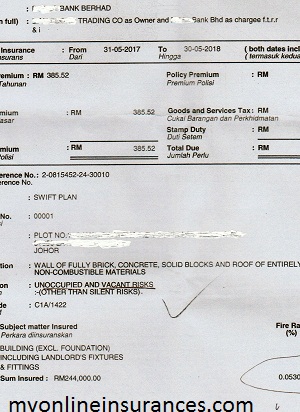

Bank wrongly insured different classes of fire insurance. The working class will always dream to have a roof over their head. In order to archive the goal, they toil hard from dawn to sunset. Some even do moonlight on several jobs in a day. They save every a single penny. They called the modern Zombie […]

Month: June 2017

The Fast claim on equipment breakdown insurance

The Fast claim on equipment breakdown insurance. Generally speaking, most households have numerous pieces of equipment at home. It can be kitchen electrical appliances, air conditioning, a robotic vacuum cleaner, or lawn movie machinery. Likewise, it is the same for a factory using equipment for fast production. Mega Risk Insurance A plastics molded manufacturer […]