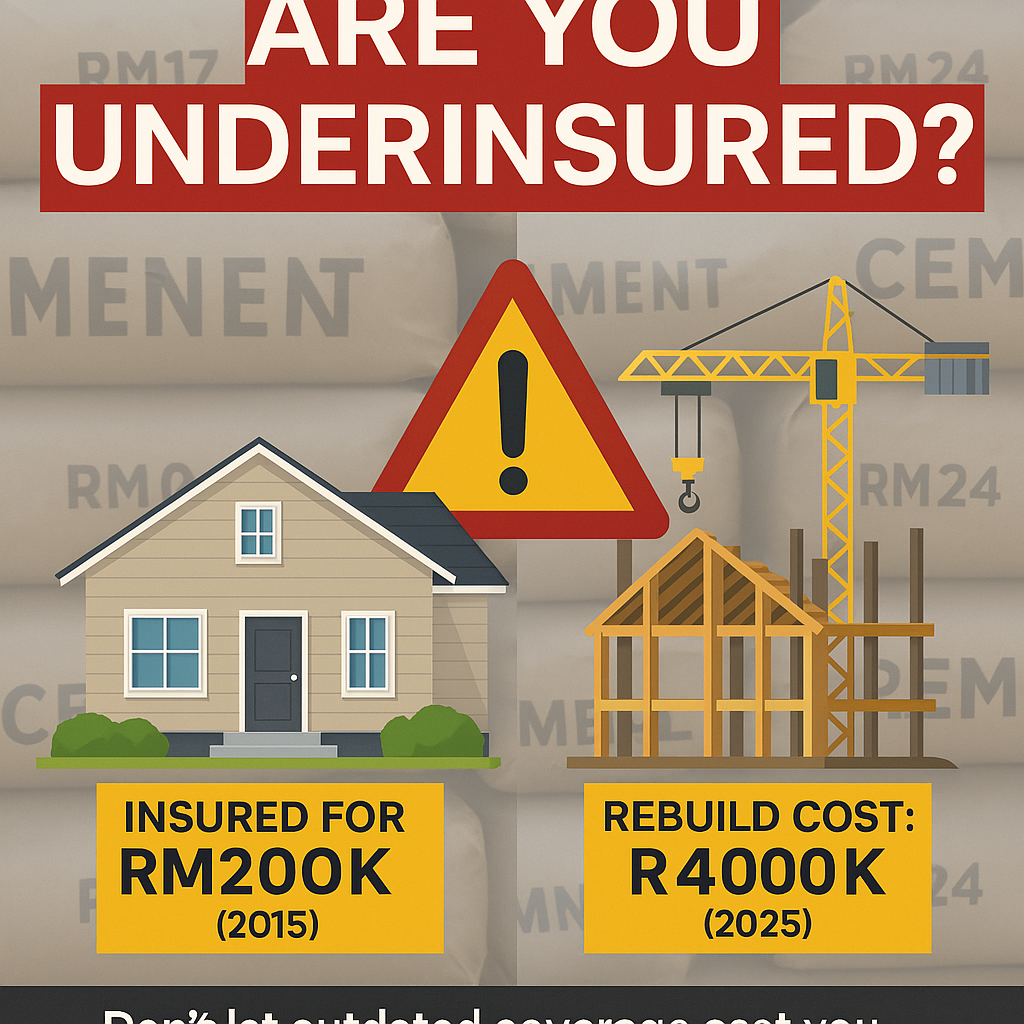

Danger of Underinsured The Hidden Danger of Being Underinsured. How can being underinsured cost you everything? Learn how inflation affects the sum insured and why accurate coverage is critical in a total loss claim. ⚠️ The Hidden Danger of Being Underinsured: What Every Property Owner Must Know Imagine this: your home was insured for RM200,000 […]

Fraud and High Medical Claims Cause Premium Hikes

Understanding the Link Between Fraud and Rising Medical Insurance Premiums.The escalating cost of medical insurance premiums is a concern that continues to plague many individuals and families. While several factors contribute to this upward trend, two key elements stand out: fraud and high medical claims. Understanding the link between these two factors and rising medical […]

Excess Claims Drive Health Insurance Premium Hikes

Understanding the Impact of Excess Claims on Health Insurance Premium Hikes Excess Claims Drive Health Insurance Premium Hikes. The escalating cost of health insurance premiums is a concern that continues to plague many individuals and families across the globe. One of the primary drivers of these increases is the prevalence of excess claims. Understanding the […]

The principle of utmost good faith with example

Understanding the Principle of Utmost Good Faith through Real-Life Scenarios The principle of utmost good faith with example , also known as “uberrimae fidei,” is a fundamental tenet in the world of insurance and contract law. It is a legal doctrine that requires all parties involved in a contract to act honestly and not withhold […]

How to claim flood damage to your car?

Steps to Successfully Claiming Flood Damage for Your Car How to claim flood damage to your car? When you find your car submerged in water due to a flood, it can be a distressing experience. However, it’s important to remember that you can claim flood damage for your car from your insurance company. This process […]

Claim flood damage in Malaysian fire insurance

Understanding Flood Damage Coverage in Malaysian Fire Insurance Policies How to claim flood damage insurance? In Malaysia, the interplay between fire insurance and flood damage coverage is a topic of significant importance, particularly given the country’s susceptibility to monsoonal rains and flash floods. Understanding the nuances of how flood damage is addressed within the framework […]

1 principle: utmost good faith binding insured and insurer

1 principle: utmost good faith binding insured and insurer. The principle of utmost good faith, also known as “uberrimae fidei,” requires both the insurer and the insured to act honestly and disclose all relevant information when entering into an insurance contract. Here’s a true-to-life example in the context of general fire insurance: Example: Scenario: John […]

Does Travel Insurance Cover Earthquakes and Tsunami?

Does Travel Insurance Cover Earthquakes and Tsunami? Does Travel Insurance Cover Earthquakes and Tsunami? Travel insurance typically covers a range of risks, including earthquakes and high-altitude sickness. For instance, if an earthquake strikes while you’re travelling, your policy may cover medical expenses, trip cancellation, and emergency evacuation However, it’s crucial to check the specific terms, as some policies exclude coverage for natural disasters in high-risk areas. High-altitude illness Travel insurance often includes medical expenses and emergency evacuation if you fall ill during a […]

Understand tour bus liability and travel insurance

We need to understand tour bus liability and travel insurance. There are vast differences between the types of insurance. Let’s break down the differential between tour bus liability and travel insurance. **Tour Bus Liability:** – **Coverage Scope**: Specifically covers incidents that occur on the tour bus. – **Primary Focus**: Protects the tour company against claims […]

Householders protect homes with peace of mind

Householders protect homes with peace of mind Householders protect homes with peace of mind in today’s world, we should protect our homes with peace of mind by having a householder policy. Safeguarding our homes is more important than ever. Yet, many homeowners overlook the crucial step of getting householder insurance. Recent surveys reveal a startling […]