Why the hack of buying life insurance at a young age?

Why the hack of buying Life Insurance at a young age? Let’s go more in-depth with real-life examples and illustrations of why buying life insurance early is important. Here’s a detailed explanation with examples that may resonate:

### 1. **Health Advantages: Lower Premiums When You’re Young**

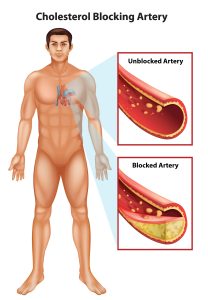

When you’re young and healthy, insurance companies see you as a lower risk, so they offer you lower premiums. Once you hit your 30s, your health can begin to decline—whether it’s gradual weight gain, higher cholesterol, or even the onset of chronic diseases like diabetes. For example:

**Example 1: Daniel (Age 24) vs. James (Age 35)**

Daniel is 24, in great health, and buys a life insurance policy with a critical illness rider. He locks in a premium of $100/month for a $500,000 sum assured. Fast forward 11 years: Daniel’s friend James, now 35, decides he should get life insurance after hearing about someone in their social circle who had a heart attack. When James goes to buy life insurance, he discovers his premiums are $250/month for the same $500,000 sum assured. Why? By this point, James has developed slightly elevated blood pressure and is considered a higher risk to the insurer. Also, he’s older, which naturally comes with higher premiums.

Why the hack of buying life insurance at a young age?

#### Key Lesson:

**Daniel** pays $100/month, while **James** pays $250/month, yet both receive the same coverage. James ends up paying much more over his lifetime. By buying young, Daniel enjoys cost savings that add up over time, all while having the same financial protection.

—

### 2. **The Unpredictability of Life: Accidents or Sudden Illness**

Many people think that because they are young and healthy, they are invincible. However, life has a way of throwing unexpected challenges our way. Accidents, sudden illnesses, or even genetic health conditions can arise out of nowhere. While we exercise and stay healthy, we can never predict when or if a sudden tragedy may occur.

Why the hack of buying life insurance at a young age?

#### **Example 2: Amy’s Story**

Amy was a fit and healthy 28-year-old marathon runner. She believed she didn’t need life insurance since she didn’t have any dependents and was focused on her career. However, she was diagnosed with an aggressive form of cancer at age 32, which required intensive treatment and left her unable to work for over a year. Fortunately, Amy had bought a life insurance policy at 29 with a critical illness rider when a friend had suggested it. Her critical illness payout of $200,000 helped cover her medical bills and living expenses while she recovered.

Imagine if Amy had delayed buying her life insurance until after her cancer diagnosis. Insurers would either refuse her coverage or apply hefty exclusions, leaving her with no financial safety net.

#### Key Lesson:

If **Amy** hadn’t bought her policy when she was young and healthy, she would have had no financial support during her illness. Her early decision to get insured gave her the security she needed when the unexpected happened.

Why the hack of buying Life Insurance at a young age?

### 3. **Financial Security for Your Loved Ones**

Even if you don’t have a spouse or children when you’re young, planning ensures your loved ones won’t face financial hardship if you pass away or become incapacitated. Accidents or illnesses can happen anytime, and life insurance ensures that your family is cared for, no matter what happens to you.

#### **Example 3: John’s Tragic Accident**

John was 30 years old, married, and had a young child. He had a good job, and everything was going well for his family. John was also an avid motorcyclist, and one weekend, while riding with friends, he was involved in a serious accident that left him permanently disabled. As the family’s sole breadwinner, his inability to work devastated the family’s financial stability. However, John had taken out a life insurance policy with a total permanent disability (TPD) rider five years earlier. The insurance paid out a lump sum of $500,000, which helped his family cover medical expenses, pay off their mortgage, and fund future living expenses.

Without this policy, John’s wife would have been forced to sell their home, and his family’s standard of living would have suffered dramatically.

Why the hack of buying Life Insurance at a young age?

#### Key Lesson:

**John’s** decision to buy life insurance early meant his family had financial security after his accident. Without that protection, they would have faced the harsh reality of selling assets, struggling with medical costs, and managing day-to-day expenses with no income.

—

### 4. **Cost Efficiency: Locking in Lower Premiums for the Long Term**

Life insurance premiums are lower when you’re young. If you buy when you’re young and healthy, you’re locking in those lower premiums for decades. On the other hand, waiting until you’re older could result in paying much higher premiums for less coverage.

#### **Example 4: Sara (Age 24) vs. Lisa (Age 36)**

Sara is 24 and decides to get a life insurance policy. For a 25-year term policy with a $500,000 sum insured, her premiums are $120/month. Lisa is 36 and decides to get the same coverage. However, because of her age, and her recent diagnosis of mild hypertension, her premiums are $330/month. Over 25 years, Sara will pay $36,000, while Lisa will pay $99,000 for the same coverage.

#### Key Lesson:

By buying at age 24, Sara saved $63,000 over 25 years compared to Lisa, all because she locked in her lower premium when she was younger.

Why the hack of buying Life Insurance at a young age?

### 5. **Avoiding Future Exclusions and High-Risk Premiums**

As you age, insurers may impose exclusions for health conditions that could have been covered if you had bought your policy earlier. Chronic illnesses such as hypertension, diabetes, or obesity often result in higher premiums or exclusions for related diseases, like heart attacks or kidney failure.

#### **Example 5: Mark’s Health Decline**

Mark is 40 and just found out he has early-stage diabetes and high cholesterol. When he tries to buy life insurance, the insurer imposes exclusions on any claims related to heart disease, stroke, and kidney failure. Mark also has to pay a higher premium of $400/month due to his substandard health status. If Mark had bought his policy in his 20s, these exclusions or premium hikes would likely be much lower, as he was healthier then.

#### Key Lesson:

**Mark** is now stuck with higher premiums and exclusions, which he could have avoided if he had locked in his life insurance coverage when he was younger and healthier.

—

### **Conclusion:**

While it’s tempting to focus on buying a car, a house, or starting a family when you’re young, life insurance should be part of your financial foundation. By getting life insurance early, you secure your financial future with affordable premiums, protect your loved ones from potential hardship, and ensure peace of mind. Remember, life is unpredictable—whether it’s an unexpected illness, accident, or even death, the consequences can be devastating if you’re not prepared. Buying life insurance is not just an investment in your future, but in the security and well-being of those who depend on you. You insure your car, a depreciating asset—why not insure the most valuable asset you have: your ability to earn and provide?

Taking action while you’re young and healthy ensures you lock in low premiums for life, gain higher coverage, and avoid future exclusions for health-related issues. It’s not about being pessimistic; it’s about being prepared. Your future self and your family will thank you for making this smart decision today.

—