Danger of Underinsured

The Hidden Danger of Being Underinsured. How can being underinsured cost you everything? Learn how inflation affects the sum insured and why accurate coverage is critical in a total loss claim.

⚠️ The Hidden Danger of Being Underinsured: What Every Property Owner Must Know

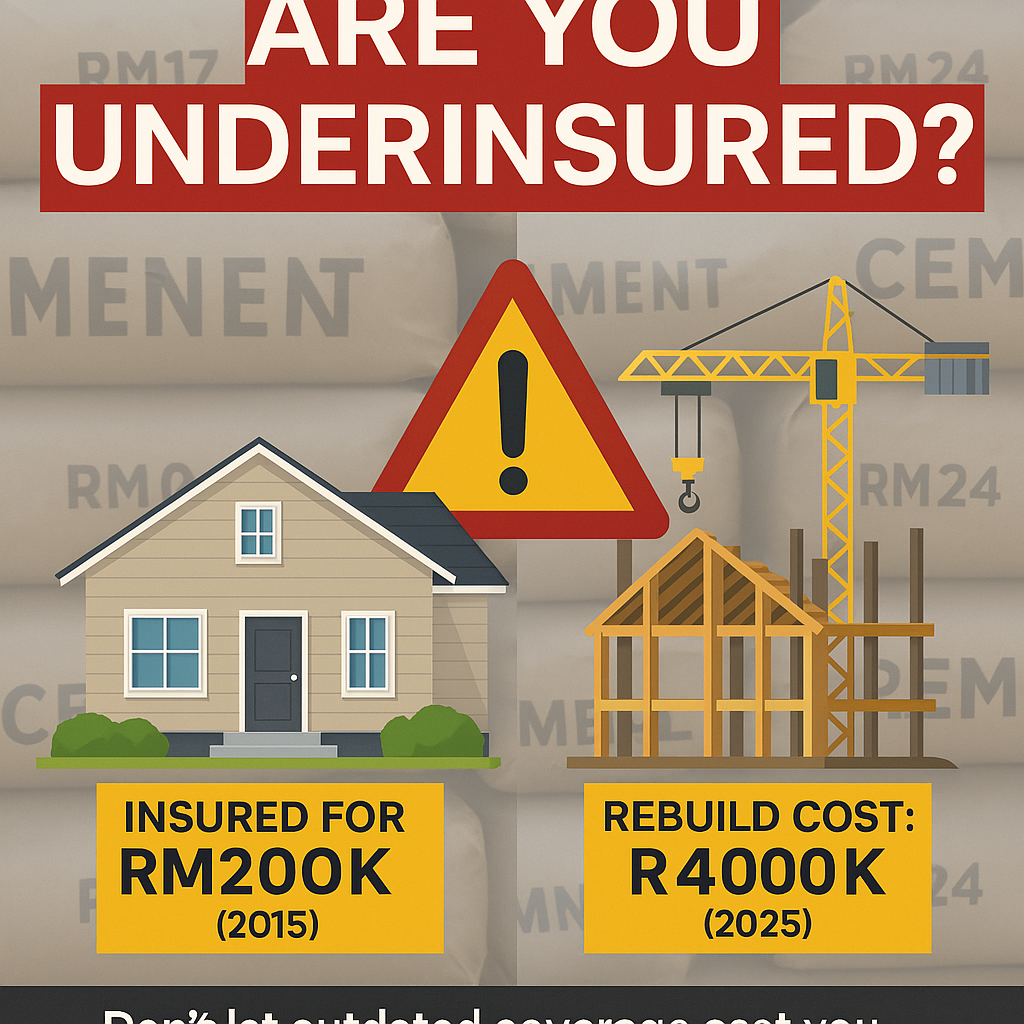

Imagine this: your home was insured for RM200,000 ten years ago. Today, it’s destroyed after a fire or flood. You file a claim, only to discover that rebuilding now costs RM400,000. But your policy still covers just RM200,000. The result? You’re left with a devastating RM200,000 shortfalls. This is the harsh reality of **underinsurance**—and it’s more common than you think.

### 🧾 What Is “Average” in Insurance?

In simple terms, the **average clause** in insurance is a penalty applied when your property is **underinsured**. If your sum insured is less than the replacement cost, your insurer will only pay a **proportion** of your claim.

#### 📌 Example:

– Actual rebuild cost: RM400,000

– Sum insured: RM200,000

– Loss: RM400,000 (total loss)

– Claim payout: RM200,000 (you bear the rest)

Even in partial losses, the payout is reduced proportionally. If you’re only 50% insured, you’ll only receive 50% of your claim, even if the damage is minor. “If you only pay half the premium, you get half the protection.”

The Hidden Danger of Being underinsured

### 🧱 Inflation Is Driving Construction Costs Sky High

Over the past few years, **building material prices have surged**. For example:

– Cement has risen from **RM17 to RM24 per 25kg bag**

– Steel, timber, and labour costs have also jumped by **15–30%**

This means a house that cost RM200,000 a decade ago may now cost **RM350,000–RM400,000** to rebuild. You’re at serious risk if your sum insured hasn’t been updated.

Example of Underinsured

### 🏚️ Real-World Claim Scenario

Let’s say you insured your home for RM200,000 in 2015. You never updated the policy. In 2025, a fire destroyed the entire building. The current rebuild cost is RM400,000.

**What happens?**

– Your insurer pays **only RM200,000** (your original sum insured)

– You must cover the remaining **RM200,000** out of pocket

– You may not be able to rebuild at all

This is not just a financial inconvenience—it’s a potential **life-altering disaster**.

Consequences of underinsured

### 📉 Depreciation vs. Insurance Value: Don’t Get Confused

In accounting, **depreciation** reduces the value of an asset over time. But insurance coverage should be based on the **replacement cost**, not the depreciated value.

> A 10-year-old house may be fully depreciated in your books, but rebuilding it still costs full price.

Never use book value or market value to determine your sum insured. Always use **replacement cost**—the amount it would take to rebuild the property today, including:

– Materials and labour

– Professional fees (architects, engineers)

– Debris removal

– Compliance upgrades

—

### 🧮 How to Determine the Right Sum Insured

To avoid underinsurance, follow these steps:

1. **Use Replacement Cost, Not Market Value**

Focus on what it costs to rebuild, not what the property could sell for.

2. **Factor in Inflation**

Update your sum insured annually to reflect rising construction costs.

3. **Include All Structures and Features**

Don’t forget fences, carports, retaining walls, and built-in fixtures.

4. **Consult a quantity surveyor.**

This is for accurate valuation, especially for commercial or high-value properties.

5. **Review Your Policy Regularly**

Especially after renovations, extensions, or major upgrades.

—

### 🧯 The Risk of Being Underinsured

Being underinsured means:

– **Reduced claim payouts**

– **Out-of-pocket rebuilding costs**

– **Delayed recovery after disaster**

– **Emotional and financial stress**

In a total loss, you may not have enough funds to rebuild your home or business. In a partial loss, you’ll still face a **proportional penalty** under the average clause.

—

### 🛡️ How to Protect Yourself

✅ **Review your policy every year**

✅ **Adjust your sum insured to match current costs**

✅ **Ask your insurer if your policy includes an average clause**

✅ **Consider a policy with automatic inflation adjustment**

✅ **Work with a trusted insurance advisor or broker**

—

### 🚨 Final Warning: Don’t Wait Until It’s Too Late

Underinsurance is a silent threat. It doesn’t show up until disaster strikes; it’s too late. Don’t assume your old policy is enough. Don’t rely on guesswork. And don’t let rising costs leave you exposed.

> “Insurance is meant to protect you. But it only works if your coverage is accurate.”

Take action today. Review your sum insured, talk to a professional, and make sure your policy reflects the cost of rebuilding your life.

We’d Love to Hear from You!

Have you or someone you know experienced the shock of being underinsured during a claim? Or do you have questions about correctly calculating your sum insured in today’s rising-cost environment?

Your stories, questions, and insights matter to us and others who may be unaware of the risks. Sharing your experience could help someone avoid a devastating financial mistake.

👉 Please leave a comment in the section below—we read every one. 💌 Feel free to email us directly at [email protected] if you prefer a private conversation.

If you found this article helpful, give it a like and share it with your friends, family, or clients. Your support inspires us to write and raise awareness about insurance protection and financial preparedness.

Together, let’s build a more informed and resilient community. 💪