Bank Promotes Outdated Mortgage Reducing Term Assurance. Why is it so? The bank placed priority on their interest first instead of the borrower on the housing loan. Too sad, that the public was willing to accept the bank offer and incorporate it as part of the loan amount. Bank Pushes Outdated Mortgage Term Assurance

I came across a case in a rural area. It was a heartbreaking story during my course of study at CII. By giving and helping the needy community, I enhanced my insurance knowledge.

“Madam, why are you selling cookies along the busy main road with three kids in tow.” I inquiries with a sympathetic eye.

“Sir, it is my fate. I have 4 school-going children, besides my bedridden husband. Already 4 months have passed, and God willing, I hope he can recover soon. According to government specialists, there is a 50% chance of recovery. He fell in the bathroom after coming home from the factory, working as an operator for the past 18 years.”

She showed me a letter from the bank stating that her husband needs to pay the arrears in 3-month installments of the housing loan; otherwise, their home for 9 people will be up for auction. She sobbed quietly behind the curtain.

“Does your husband purchase an investment link policy?”

” Here it is.”

“It is a mortgage-reducing term assurance policy!” I advised her.

“How do I know? The bank asked me to pay the installments”

Likewise, it is the same as my son’s case.

After securing my son’s loan from a bank, the loan officer asked my son to sign the mortgage-reducing term loan form.

I asked her, “If my son is bedridden, does he have to pay the housing loan installments?”

“Yes, of course,” the loan officer replied.

” If my son, after settling this loan, wants to have another second house, does he need to buy another MRTA? ”

“Yes, of course.”

Bank Pushes Outdated Mortgage Term Assurance

The Cons of MRTA

No cash surrender value, no loan.

During your tenure loan period. If you need a small loan to cover your emergency fund due to short-term unemployment or hospitalization, you need 20,000 dollars. One needs to present the original investment link policy to the insurance company; you will get the funds within 24 hours during the working day. There is a small interest charge of 7-8% for the outstanding loan, but it is not compounding.

Bedridden, continue paying instalment

Despite being out of a job due to illness, you still need to pay the instalment. Coupling with the higher burden of the medical fee, no job. Can the borrower continue paying the loan instalment?

TPD or Death

Can the survivor suffering from TPD and the family live in the fresh air and the sunshine? After paying the balance of the housing loan, you get the title out from the bank without any encumbrance. No cash in hand; eat bread and drink plain water? In the investment link policy, after paying for 15 years, and the housing loan balance, let’s say 50,000 for another 5 years. If you are insured for 200,000 plus 15 years on a dividend amounting to 96,000.00 The surviving family will get (200,000 + 96,000-50,000 = 246,000). In the case of MRTA, you only have a title to the house for free staying, enjoying the fresh air and the sunshine.

Bank Pushes Outdated Mortgage Term Assurance

MRTA Interest

The silent killer, since the whole premium at the inception date is rather huge, in order not to add burden to the borrower. The bank sheds crocodile tears by incorporating part of the loan installment. Another interest is added.

Buying a 2nd home

MRTA is not transferable; you need to have another policy for the 2nd housing loan. As one age, the premium will be higher, even worse, whether you are insurable or not due to ill health. With the investment link policy, you need not buy another policy, but a smaller amount of sun insured, unless the 1st policy is insufficient to cover the 2nd home loan.

Critical illness

Unless the insured dies of a critical illness or natural death, the MRTA will respond. If you are suffering from 36 major critical illnesses, for example, cancer, you still have to pay your housing loan.

If you like my article.

Please share it with your friend or family member. Sharing is joy doubles. I welcome any suggestions and comments, or you can subscribe to my mailing list.

Email me at [email protected].

Thanks

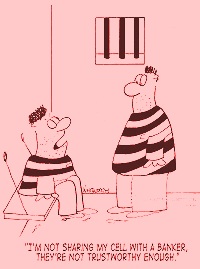

It is a business right? I see these bankers the same way I see auto sales representatives. They always have that “I will help you” promise. But in reality is, they only want to make their quota and get their bonuses.

thanks for reading my article and comment. Profit is their priority.

Certainly an eye-opener. Great info!

– Nehpets

thanks for reading my article and comments. Be careful dealing with the bank.

Great article on the con of MRTA. It is so important people know about this. the fact that you need a second policy for each subsequent loan is a disgrace. Well done on highlighting this issue!

Thanks for reading this article and comment. It is true, the bank always placed their priority first. Profit maximization is their core business.

Very interesting read, seems like one has to read the fine print, Banks are in the business of ripping people off

Thanks for reading my article and comment. Bank and insurer are the same. You have to read and understand the fine print, otherwise, you are in hot soup later.