How to claim bush/lalang destroy your home It’s been scorched and hazy in most parts of the country. Here is a “simple write-up” about standard fire insurance policy coverage for losses caused by bush (or lalang) fire damage to your home. How to claim bush/lalang destroys your home? Bush fires can erupt at any time. […]

Author: jamin

Does Travel Insurance Cover Earthquakes and Tsunami?

Never Trust what the bank says about insuring a house loan. Never trust what the bank says about insuring on a house loan on fire insurance. Don’t take the bank for granted. Let us dive in, looking at two different scenarios. After signing the Sale and Purchase agreement with a developer with a ten percent […]

How to claim flood damage to our home?

claim flood damage to our home claim flood damage to our home? However, the thump-up also broke down political and religious barriers. On a lighter note, the current government and the opposition leader hugged to share the most pressing burning issue: cleaning up the aftermath. Furthermore, recent religious debates have tarnished other faiths; a small […]

How to claim impact damaged by another or your car

How to claim impact damaged by another or your car. A plunging palm oil truck tanker crashed into the front portion of the house, causing severe impact damage to the hall, situated beside the main road. Who to claim for impact damage? Nowadays, commonly seeing your home crashed by road vehicles is highlighted in the […]

How do claims impact damage by the owner’s car to a home?

Claim Hurriance Damage to Your Property

How to claim Hurriance damage to your property if you have sustained a heavy loss or damage. Damage from Hurricane Irma If a storm damages your property, It is the wise choice you to report your claim directly to your insurer. They will have a claims agents accessible 24 hours a day. Note down the […]

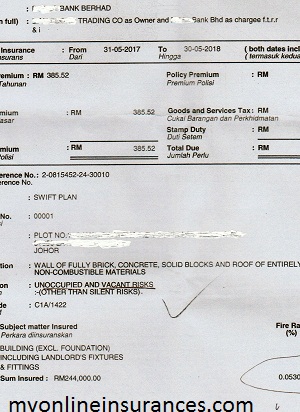

Bank wrongly insured different classes of fire insurance

Bank wrongly insured different classes of fire insurance. The working class will always dream to have a roof over their head. In order to archive the goal, they toil hard from dawn to sunset. Some even do moonlight on several jobs in a day. They save every a single penny. They called the modern Zombie […]

The Fast claim on equipment breakdown insurance

The Fast claim on equipment breakdown insurance. Generally speaking, most households have numerous pieces of equipment at home. It can be kitchen electrical appliances, air conditioning, a robotic vacuum cleaner, or lawn movie machinery. Likewise, it is the same for a factory using equipment for fast production. Mega Risk Insurance A plastics molded manufacturer […]

Air Transportation Linear Accelerator Ex USA after 9/11

How can the Air Transportation Linear Accelerator Ex USA be underwritten after 9/11? I was in Kuantan port at that particular time as part of the team investigating a shipment from Indonesia being hijacked. Lloyd Intelligence mid-ocean satellite AIS coverage detected the ship was abandoned at the Kuantan port minus cargo. Back at the hotel for a rest, […]

Bank Misrepresentation Puts Insurers at Risk

Banks misrepresent consumers, putting insurers at risk. By exploiting consumer ignorance, banks make excess profits and expose insurers to potential losses, especially in underdeveloped nations where laws and regulations governing bank activities are lacking. This unethical practice needs better oversight to protect all parties involved. Bank Misrepresentation Puts Insurers at Risk Freight Forwarder. In addition […]