Bank wrongly insured different classes of fire insurance.

The working class will always dream to have a roof over their head. In order to archive the goal, they toil hard from dawn to sunset. Some even do moonlight on several jobs in a day. They save every a single penny. They called the modern Zombie living merely eat and sleep. They come out to face the sunshine when they save enough to make the 10% or even 30% down payment. Are they happy? Please read on.

Client’s Call

“Jamin, how come your insurer sent my fire insurance policy to the old address? The building had already been demolished.” My relative called me during a fine morning after having my morning 10.00 break.

“Let me check first; I shall call you later.”

“What is the policy number you are referring to? I asked her.

“I do not have such a policy number; could it be you taking a loan from a bank? It arranged the fire insurance on your behalf.”

Yes, it is correct; the bank already auto-debit my account for the past 3 years on this shophouse.” she answered me with a soft tone.

I was on my way back home on a routine visit to the hospital. I dropped by to read their policy, shocking to find out that the bank for the 3 years making the same imbecile mistake.

Classification of Risk

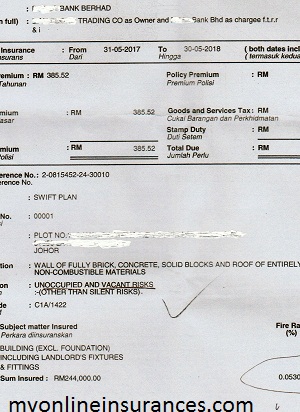

As per attachment here, the policy stating the building is vacant and occupied also the sum insured. But, in fact, it occupied as a shop doing retaining business. Dear readers, let us think outside the box.

Which risk is higher? Is it the vacant shophouse or the retailer? The answer is crystal clear: the retail business attracts many customers, thus the higher the risk compared with the unoccupied building.

The vacant risk the insured pay lesser premium, higher for the retailer shop house. Occurring of fire razed the building to ash, will insurer pay? The Principle of Utmost good faith shall apply to whom. Is the bank or the insured party?

Insurable Interest

Malaysia is a unique country with different rules and regulations. The local bank also has a subsidiary composite insurance. It could be general or life insurance. Despite the Bank Negara Malaysia gave warning to the bank stating it could not force the borrower to buy fire insurance with them. Nevertheless, it has fallen to a deaf ear, either the bank is greedy to make an excess profit out from the borrower or the insured is very ignorant. Do bank has any insurable interest in the building? Does the bank suffer any financial loss without the building?

Creditor Insurance

The insured continues paying the installment even without the building being present. The bank providing the credit to the borrower should issue the creditor’s insurance to the borrower. In the event the borrower passes away, the bank would suffer financial loss, as it has insurance interest on the loan amount, not on the building.

Under insurance

The Malaysian ringgit has depreciated against the US dollar by about 30-35% coupling with the 6% of GST implemented on 1st April 2015. It was inadequate to cover the building that was bought from the developer in 2014. The purchase price was RM350 000.00 and the loan amount was RM244 000.00. On 2017, the sum insured was still the same amount as before without any upward adjustment. No inflation for the past 3 years in Malaysia? Even the kid knows the answer. When a claim occurs, the average would apply: people would say insurers always conned people.

Do you like my article

Please share it with your friend or family member. Sharing is joy doubles. I welcome any suggestions and comments, or you can subscribe to my mailing list.

Please email me at myonlineinsurances.com

Great article on making sure to get the correct insurance. It just goes to show that having the correct policy can save you money and make sure you are properly covered in the event of an accident.

Thank for reading my article and giving me a valuable comment. It is better to check the policy coverage before any claim occurs.

It’s always important that we take our time and read the right information, so thank you very much for letting us know about getting the ‘right’ insurance.

Thank for reading my article and giving me a valuable comment. It is wise to take your time to read and digest the policy content.

Thank you for the information. Some Insurers are very sneaky and tend to hide the fine detail. It’s only after you file a claim that you are slapped with the full details of what you actually signed up for. Always read the fine detail, or pay a lawyer a small fee for them to break it down for you in layman’s language.

Thank for reading my article and giving me a valuable comment. Insurers are not only sneaky but often trying their way out to deny their liability in the event of any claim.