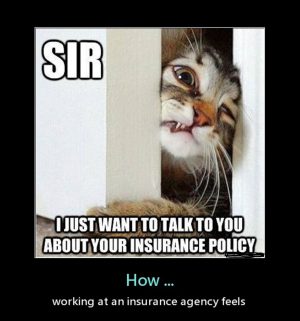

In this internet digital world, whatever information on the insurance subject can be found on the internet by the click of your finger. Do you really need an insurance agent in the digital world? Many may think otherwise. Too many negative pictures painted on those earlier day insurance agent. I remember vividly a joke during my 1st years […]