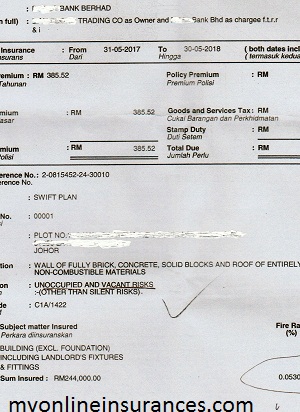

Bank wrongly insured different classes of fire insurance. The working class will always dream to have a roof over their head. In order to archive the goal, they toil hard from dawn to sunset. Some even do moonlight on several jobs in a day. They save every a single penny. They called the modern Zombie […]

Category: risk management

Air Transportation Linear Accelerator Ex USA after 9/11

How can the Air Transportation Linear Accelerator Ex USA be underwritten after 9/11? I was in Kuantan port at that particular time as part of the team investigating a shipment from Indonesia being hijacked. Lloyd Intelligence mid-ocean satellite AIS coverage detected the ship was abandoned at the Kuantan port minus cargo. Back at the hotel for a rest, […]

Enough Sleep to Avoid the Car Accident in Malaysia

Getting eight hours of sleep each night is a luxury for all of us. By having enough sleep to avoid the car accident in Malaysia A total of 18 people died daily in road accidents nationwide 2015 in Malaysia. It is an alarm to note the number of road accidents last year has also increased. In 2014, […]