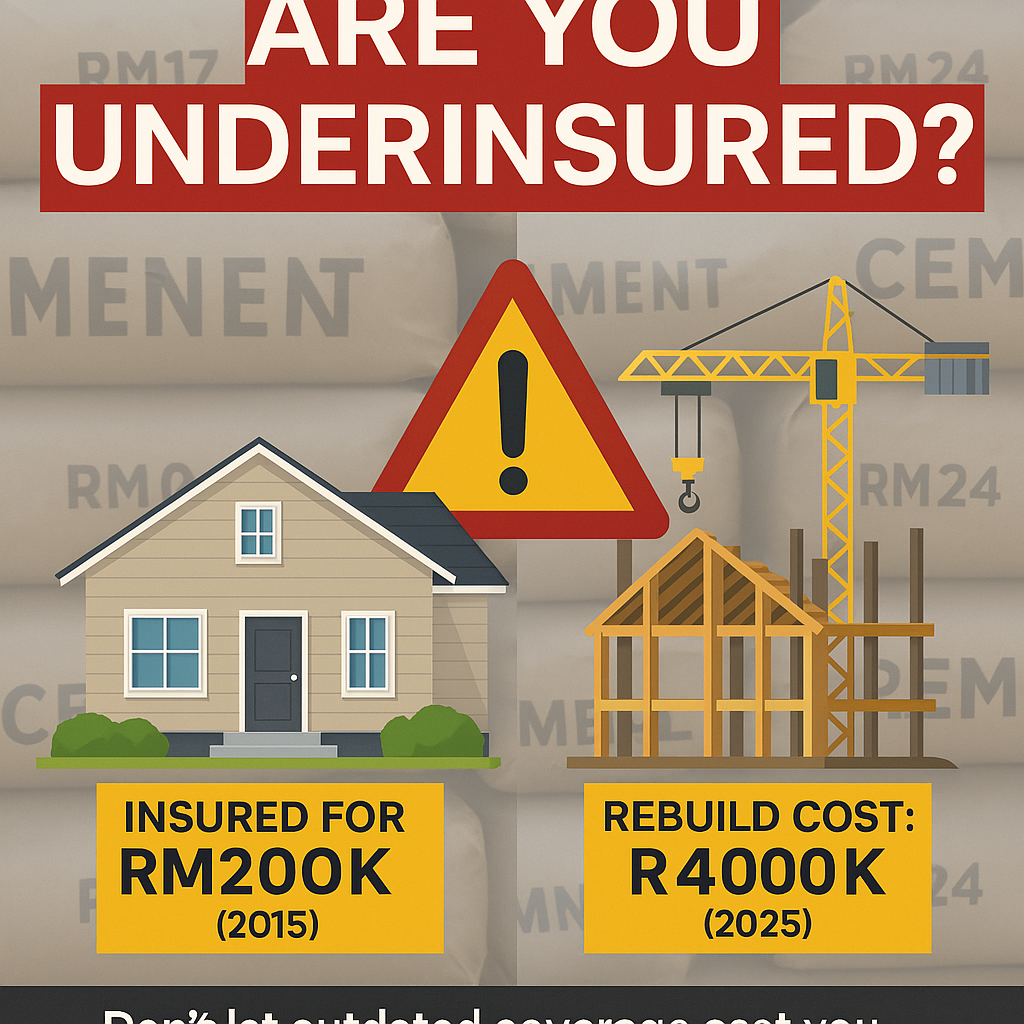

Danger of Underinsured The Hidden Danger of Being Underinsured. How can being underinsured cost you everything? Learn how inflation affects the sum insured and why accurate coverage is critical in a total loss claim. ⚠️ The Hidden Danger of Being Underinsured: What Every Property Owner Must Know Imagine this: your home was insured for RM200,000 […]

Category: Uncategorized

Frequent Storms Batter Malaysia Homes

Frequent storms battered Malaysian homes on March 13, 2017, from 5 pm to 6 pm, causing significant damage. Fallen tree branches damaged several cars, and some houses lost their roofs, including the emergency room of Kulai Hospital. How often do storms lash Malaysian homes? Storms in Malaysia can occur quite frequently, especially during the monsoon […]