Householders protect homes with peace of mind

Householders protect homes with peace of mind in today’s world, we should protect our homes with peace of mind by having a householder policy. Safeguarding our homes is more important than ever. Yet, many homeowners overlook the crucial step of getting householder insurance. Recent surveys reveal a startling trend: many consumers do not purchase householder policies, due to a lack of awareness. It is vital for intermediaries, such as insurance agents and brokers, to educate homeowners about the importance of this coverage.

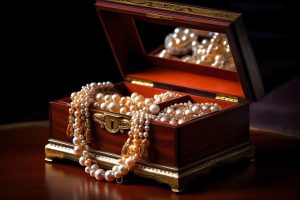

Consider the story of Mr. Tan, a resident of Kluang, Malaysia. One evening, Mr. Tan returned from work to find his front door ajar. His heart sank as he realized his home had been broken into. Values were missing, and the sense of violation was overwhelming. Unfortunately, Mr. Tan had not invested in householder insurance, leaving him to bear the financial burden alone. The stolen items included a laptop, a TV, and several pieces of jewellery—totalling over RM10,000.

Householders protect homes with peace of mind

If Mr. Tan took up by householder insurance, his policy would have compensated for the stolen items. He repaired the damage caused during the break-in and even provided temporary accommodation if his home was uninhabitable. This real-life example highlights the importance of householder insurance in protecting one’s financial and emotional well-being.

The benefits of householder insurance extend beyond theft protection. This coverage also, safeguards against natural disasters like fires, floods, and storms. It can even cover personal liability, offering protection if someone is injured on your property. With such comprehensive coverage, householder insurance is a smart investment for anyone who values their home and belongings.

Home Protection

Despite these benefits, many consumers remain unaware of householder insurance or its advantages. This lack of knowledge can leave them vulnerable to significant financial losses. Therefore, intermediaries play a crucial role in bridging this gap. They must actively inform and educate homeowners about the importance of householder policies, highlighting real-life examples and practical benefits.

Householders Policy

In explaining the householder insurance policy, an agent should use clear and simple language. Sharing stories of real-life incidents, like Mr. Tan’s theft experience, can help illustrate the potential consequences of not having coverage. Additionally, highlighting the affordability and flexibility of insurance plans can make them more appealing to consumers.

Consider the story of Mr. Jimmy and his wife, Dr. Lee, a busy professional couple from Kluang, Malaysia. Mr. Jimmy runs his own business, while Dr. Lee is a pathologist at a reputable private hospital. They employed a live-in maid to handle the cleaning, laundry, and cooking. One evening, they returned home to find that their maid had abandoned the house, taking with her a box of jewellery worth about US$100,000.

Fortunately, Mr. Jimmy and Dr. Lee had a householder insurance policy with full theft coverage. Upon discovering the theft, they immediately reported it to their insurance provider. The police responded swiftly, covering the value of the stolen jewellery. This financial support was a significant relief, as it allowed them to replace the precious items without enduring the financial strain themselves.

Householders Full theft Insurance

Optional Cover for Contents Only

Full theft coverage is available to specific clients who pay an extra premium. Unlike standard theft cover, this extension protects against theft even without signs of forced entry. This means if thieves use a duplicate or master key, or trick you into opening the door, you’re still covered. The higher risk associated with this extension justifies the additional premium, and it’s not available to everyone.

A theft must occur for this cover to apply. Even without signs of forced entry, you must realize items have been stolen. This policy won’t cover simply missing items without a clear theft incident.

Remember, there’s an RM250 excess under this extension, meaning you’ll bear the first RM250 of any theft claim without signs of forcible entry or exit. This ensures coverage is fair and justified for everyone.

Even the use of a duplicate or master key, or even that you are tricked into opening the door for thieves, would be covered. The risk this extension covers is higher, hence the need to charge an additional premium. This is also why this cover is not given to just anyone.

Although there need not be any sign of forcible entry, this does not mean the policy will also cover if your property is missing for no apparent reason. A theft must occur. That means you realize a theft has occurred. The only thing is that you do not know how the thief entered your home.

Note also that there is an excess of RM250 under this extension. This means that you will have to bear the first RM250 for every claim involving theft where there is no sign of forcible entry or exit.

The householder insurance policy covers the normal theft coverage.

Burglary/theft insurance protects your property if someone breaks in or out using force or violence. This policy also covers damage to your property during a theft, attempted theft, or incidents like armed robbery.

Here’s what you can insure under this policy:

Personal or business property: If you have goods in your home or business that need protection, especially stock-in-trade.

Goods held in trust: Items you are responsible for, even if they belong to someone else.

Furniture and fittings: Your home or business furniture, fixtures, and utensils.

Household goods and personal effects: personal items and household goods.

But there are some exclusions. The policy won’t cover:

Fire or explosion damage.

Theft by you, your family members, or employees.

War, strikes, riots, or civil commotion.

Radioactive contamination.

Understanding these exclusions is key. For risks not covered by burglary/theft insurance, consider additional policies to ensure complete protection for you and your business. This way, you’re fully prepared for any situation.

Insurance agents and brokers can also utilize digital platforms to reach a broader audience. Creating informative blog posts, social media content, and online videos can help spread awareness about the importance of household insurance. Engaging with customers through these channels allows intermediaries to answer questions, address concerns, and provide personalized advice.

Essential of Householder insurance

In conclusion, householder insurance is essential for protecting your home and peace of mind. The coverage for theft, natural disasters, and personal liability. It offers comprehensive protection for homeowners. However, the lack of awareness among consumers highlights the need for active education by intermediaries. By sharing real-life examples, using relatable language, and leveraging digital platforms, insurance agents and brokers can help homeowners understand the importance of householder policies. Don’t wait until it’s too late—get informed and protect your home today.