Frequent storms battered Malaysian homes on March 13, 2017, from 5 pm to 6 pm, causing significant damage. Fallen tree branches damaged several cars, and some houses lost their roofs, including the emergency room of Kulai Hospital. How often do storms lash Malaysian homes? Storms in Malaysia can occur quite frequently, especially during the monsoon […]

Category: insurance claim

Insurer and Agent Ignore Duty of Disclosure

Insurer and agent ignore duty of disclosure. The insurer and agent are not following the duty of disclosure. In the insurance industry, there is a rule that the applicant must sign on the dotted line before the agent can submit the proposal form to the company. In the life insurance industry, to fulfil the quote or qualify […]

Full theft vs burglary insurance policy

What is the difference between a full theft and a normal burglary insurance policy? The bank misled the lawyer on the insurance policy, assuming she understood all terms, clauses, warranties, and exclusions. This is a common wrong assumption, as the lawyer is not trained in all technical insurance jargon. Missing Gold Necklace I recall […]

Conman Secures Full Insurance Settlement

“Conman Secures Millions in Fraudulent Insurance Settlement” Is it easy to cheat insurers to claim money? A true story about how a conman cheated an insurance company. Revealing the complexities and risks involved in the garment industry. Learn the details in this true story. Conman Secures Full Insurance Settlement Garment Factory Fire Garment factories need […]

Better Claim Service: Independent Agent vs. Bank

Independent Agent vs. Bank: Better Claim Service. Choosing between an independent insurance agent and a bank for your insurance claims can significantly impact your experience. While many assume banks offer better service, real-life incidents reveal otherwise. Here are three true stories that highlight how banks can fall short compared to independent agents. Malicious Damage Incident […]

Palm Oil Lorry Crash: Can You Claim Fire Insurance?

Palm Oil Lorry Crash: Can You Claim Fire Insurance? A palm oil lorry tanker crashed into the front portion of a house, causing severe impact damage to the hall. This house is situated beside a main road. Whom should you claim for impact damage? Such incidents are commonly seen in daily newspapers. What is […]

Utmost Good Faith: Insured and Insurer’s Binding Part V

Utmost Good Faith Binding Between Insured And Insurer Part IV Two policies cover the same consignment, a small claim response, but the insurer rejected the bigger sun-insured claim. The story of the insurer not following the Utmost good Faith rule by the insurer. In Malaysia, it is common for the insured or a transporter to […]

Utmost Good Faith: Insured-Insurer Binding Part III

Utmost Good Faith: Insured-Insurer Binding Part III. How did the insured make use of the loophole of the Utmost Good Faith? I am eager to prove my capacity to earn the non-motor insurance profit commission besides the normal agent commission during my first year as an agent/broker after I quit my full-time job in a […]

Utmost Good Faith: Insured and Insurer Binding Part II

Utmost Good Faith Binding Between Insured and Insurer Part II What is Fraudulent Misrepresentation? Fraudulent misrepresentation, also known as concealment, happens when the insured fails to disclose important information. For an insurance company to deny payment due to concealment, it must prove that: The insured knew the fact was crucial for the insurance being applied […]

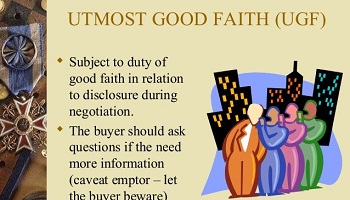

Utmost Good Faith in Insurance: an essential principle

Utmost Good Faith in Insurance: Essential Principle, how it applied to the insurer and insured in the proposal. Utmost good faith, or Uberrimae Fidei, is a key principle in insurance law. It requires everyone involved in an insurance contract to act honestly and disclose all relevant information. The insured must provide accurate details […]