Utmost Good Faith: Insured-Insurer Binding Part III. How did the insured make use of the loophole of the Utmost Good Faith? I am eager to prove my capacity to earn the non-motor insurance profit commission besides the normal agent commission during my first year as an agent/broker after I quit my full-time job in a […]

Utmost Good Faith: Insured and Insurer Binding Part II

Utmost Good Faith Binding Between Insured and Insurer Part II What is Fraudulent Misrepresentation? Fraudulent misrepresentation, also known as concealment, happens when the insured fails to disclose important information. For an insurance company to deny payment due to concealment, it must prove that: The insured knew the fact was crucial for the insurance being applied […]

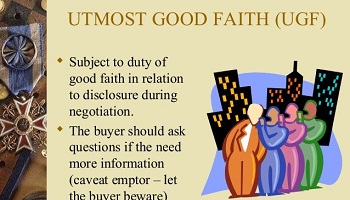

Utmost Good Faith in Insurance: an essential principle

Utmost Good Faith in Insurance: Essential Principle, how it applied to the insurer and insured in the proposal. Utmost good faith, or Uberrimae Fidei, is a key principle in insurance law. It requires everyone involved in an insurance contract to act honestly and disclose all relevant information. The insured must provide accurate details […]

Insurer Denies Claim: Genuine Fire, No Settlement

Why no claim? When I joined a public listed insurer, my branch manager handed me a mountain of claim files. I diligently reviewed them at home, working late into the night. After a month of local training, I attended another two weeks of training at the headquarters with senior underwriting and claims managers. Yet I […]

Banking Secrets: Why Pay More? Part III

Banking Secrets: Why Pay More? Part III What is indemnity? Indemnity means compensation for loss, damage, or injury. It’s a contract where one party agrees to pay for the losses or damages incurred by another. Usually, this stems from a contractual obligation to protect against liability, loss, or damage. Simply put, insurers pay to reinstate […]

Banking Secrets Revealed, Why Pay More? Part II

Banking Secrets Revealed, Why Pay More? Part II. Please refer to my Banking Secrets Revealed, why pay more? Can the ground that erected your house can fire it down? When you buy a landed property, be it freehold or leasehold, the housing developer will charges you the land price too. In Malaysia, it is charged […]

Insurers Idnemnity New for Old Electrical Appliances?

Insurers Indemnity New for Old Electrical Appliances? Can you believe it? If insurers do pay your claim.The public would have two responses.” I….s that tr…….ue? Martin asked with his unbelievable eye. ” Yes, my Led Television which I brought in 2014, the recent lightning damaged it, the insurer paid me the 2017 current price” Mary […]

Need an insurance agent in the digital world

In this internet digital world, whatever information on the insurance subject can be found on the internet by the click of your finger. Do you really need an insurance agent in the digital world? Many may think otherwise. Too many negative pictures painted on those earlier day insurance agent. I remember vividly a joke during my 1st years […]

Enough Sleep to Avoid the Car Accident in Malaysia

Getting eight hours of sleep each night is a luxury for all of us. By having enough sleep to avoid the car accident in Malaysia A total of 18 people died daily in road accidents nationwide 2015 in Malaysia. It is an alarm to note the number of road accidents last year has also increased. In 2014, […]

How to buy car insurance online Malaysia Free Premium Calculator

How to buy car insurance online Malaysia free premium calculator. Types of Car Insurance Cover in Malaysia Cover Third Party Cover Third Party, Fire & Theft Cover Comprehensive Cover Liabilities to the third party for: Injury Death Property Loss / Damage ✔ ✔ ✔ Loss/damage to own vehicle due to accidental fire/theft ✘ ✔ ✔ […]