Do you need cashless admission medical insurance? Have you ever had to rush to an ATM in the middle of the night because someone needed medical attention? Have you asked for money from friends or family? You even used up all the credit card limitations, yet the private hospital does not allow your family to […]

Tag: Cashless admission medical card

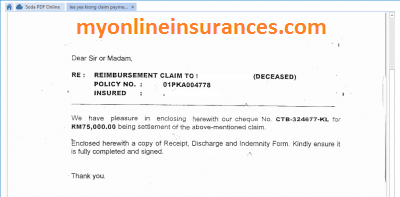

Utmost Good Faith: Insured and Insurer Binding Part IV

Utmost Good Faith: Insured and Insurer Binding Part IV. The insurer has a bigger role in Utmost Good Faith binding both parties, namely the insurer and the insured. Liver Transplant Tragedy Friday, June 7, 2002, on Singapore Strait Time, carried the title “Transplant tragedy: Heartbreak for wife: ‘He died not knowing I was pregnant.’ Transplant […]