Utmost Good Faith: Insured and Insurer Binding Part IV. The insurer has a bigger role in Utmost Good Faith binding both parties, namely the insurer and the insured.

Liver Transplant Tragedy

Friday, June 7, 2002, on Singapore Strait Time, carried the title “Transplant tragedy: Heartbreak for wife: ‘He died not knowing I was pregnant.’ Transplant tragedy: Too much money, Too little time, Frantic rush to raise funds. Liver Transplant Tragedy: “Donor available, but critical delay over cost proves fatal.” No Money, No surgery.

A sorrowful heartbreak story flashed across the local daily newspaper. People cursed the heartless surgeon. The insurer refused to pay the so-called cash admission to the local private hospital. He was later transferred to another private hospital in Singapore for a liver transplant. The donor was none other than the late patient’s elder sister, who sacrificed her liver and spent countless sleepless nights to raise funds for her beloved younger brother.

Jaundice

The local hospital diagnosed him as suffering from jaundice. He needed to pay the admission fee of RM5,230.00. The medical card was supposed to be a cashless admission. Finally, the consultant confirmed he was suffering from hepatitis B. Like adding salt to the wound, time delay, and the patient in critical condition, the ambulance rushed him off to a Singapore private hospital to perform the liver transplant.

No money, no surgery

“First you need to find the right donor for a liver transplant; secondly, S$300,000 in full payment as a cash deposit before the surgeon can operate.” The hospital concerned informed them, “No money, no surgery.”

To cut the story short, the money was raised, and the elder sister was admitted to the hospital for a liver transplant on the following day. Her youngest brother, who could not hold longer, was called to be with the Lord in the wee hours of the morning.

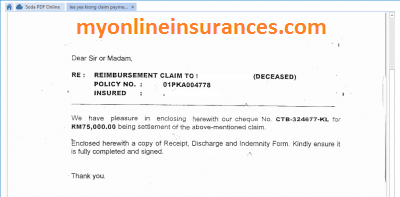

Whatever is gone, ash to ash, dust to dust, but the living need to go on with their lives. The deceased family filed a claim for a sum insured of RM75,000.00 to the general insurance company for the medical card claim. It was a shocking reply from the insurer.

Not Claimable

It is with deep regret that I inform you that the medical expenses for the treatment of your condition are not claimable under the following policy exclusion:

General Exclusion (11): “suicide or attempted suicide, self-inflicted injuries, self-destruction or any attempt thereat while sane or insane. ”

General Exclusion (9): “… treatment of alcohol dependence syndrome and drug addiction/abuse.”

After countless visits to the hired lawyer, there is no outcome. But the lawyer charged the family RM2,000 to open a file. Also, numerous appeal letters to the Malaysia Mediation Bureau turned out fruitless.

It was a coincidence I stumbled across his sister, and after a few chats, we realised we were colleagues before. We chatted over a high tea.

” Jamin Wong, can you please help me to claim my late brother’s case? Since after we departed, you continued with your Chartered Insurance study, I am sure, and you have the confidence to help me.” She pleads with me.

” Sure, It is my pleasure to help with those genuine claims, but this lawyer’s correspondence letter, please do not give it to me. I want the proposal form, cover note, policy jacket, and rejection claim letter. If I had 90% winning the case, I would write an appeal letter on your behalf to Bank Negara Insurance Mediation Bureau. Is that OK with you.

In the proposal form, the brother wrote that he was a hepatitis B carrier. Also, there were no exclusion clauses specified in a few years’ renewal. A close study of the liver specialist’s diagnostic report confirmed the patient died of acute liver failure due to hepatitis B.

The insurer did not honour Utmost Good Faith

The insured had carried the duty of Utmost Good faith in disclosing he was a hepatitis B carrier in the proposal form. Whereas the insurer did not honour the Utmost Good faith on their part.

Happy Ending

With just one A4 paper size written in the appeal letter. All happy endings. On 30-7-2004, the widow received a cheque amounting to RM75,000 from the insurer.

Two policies cover the same consignment, a small claim response, but a bigger, sun-insured claim was rejected. Another story does not follow the Utmost good Faith rule by the insurer; more in the next episode.

If you like my article.

Please share it with your friend or family member. Sharing is joy doubles. I welcome any suggestions and comments, or be a subscriber to my mailing list.

Please email me at [email protected].

Thanks

You did an awesome job Buddy!

It is people like you who makes this world a better place to live.

Inspired!

Thanks, Buddy. It is everybody duty to make our world a better place to live.

This is such a wonderful concept. Something not a lot of people may not know about. Very helpful information. Great job. Very unique and well written.

It is my pleasure to help others. Thanks for the compliments.

Raymond Huang If you have no money for treatment in a private hospital, you will have no choice but to go to a government hospital. Private hospitals are now commercialised and are profit centered. No money, no talk – that’s it.

Like · Reply · 2 · February 24 at 11:23pm

Hide 12 Replies

Skong Wong

Skong Wong Please read the whole story, before you jumped to the conclusion.

Like · Reply · February 24 at 11:24pm

Raymond Huang

Raymond Huang Sorry. I did not read the whole story. I responded on the heading ‘no money, no surgery …’ Tell us about this unhappy episode where you have given a heading of ‘no money, no surgery, no claim’.

Like · Reply · February 24 at 11:39pm

Skong Wong

Skong Wong Do you know what I want to convey here?

Like · Reply · February 24 at 11:43pm

Raymond Huang

Raymond Huang Tell me.

Like · Reply · February 24 at 11:44pm

Skong Wong

Skong Wong Utmost Good Faith Binding Between Insured And Insurer Part

Like · Reply · February 24 at 11:49pm

Skong Wong

Skong Wong Red the claim being rejected.

Like · Reply · February 24 at 11:51pm

Raymond Huang

Raymond Huang Thank you.

Like · Reply · February 24 at 11:53pm

Skong Wong

Skong Wong Do you know the outcome ?

Like · Reply · February 24 at 11:58pm

Raymond Huang

Raymond Huang Good ending

Like · Reply · Yesterday at 12:04am

Skong Wong

Skong Wong I love to deal with Insurance claim being rejected by the insurer. I aware that when any claim occurred, the Malaysian always go for the help of a lawyer. The Majority of them has no knowledge of insurance law other than motor liability claim unless the lawyer doing master degree in law with insurance law major.Besides helping the community and it also enhanced my insurance knowledge day by day.

Like · Reply · Yesterday at 12:14am

Raymond Huang

Raymond Huang Good of you to help the community. Now, what’s happens when the case is deadlocked and you need to file a court case?. Do you give the case to a lawyer with experience in insurance law or you work alongside him in collaboration?

Like · Reply · Yesterday at 12:20am · Edited

Skong Wong

Skong Wong I did mention the deceased sister did open a file with a JB lawyer in 2002, but nothing happened until 2004 when the widow received a cheque for full settlement. I did not go to court, nor collaboration with any lawyer. It is a simple A4 paper attacked the loophole of that policy. If you really understand and read through between the line on my post. You will know the clue too. The lawyer did file a case in the court much earlier. In the earlier August when I was there to meet the sibling, the lawyer still not aware the cases being fully settled. He asked for more support documents to file the claim. The sibling told me off. This case was the longest in my claim history, it drags on for almost 6 months by the Insurance Mediation Bureau. I too spent 1 week to go through all the reports, namely Euro Assistance, Local private hospital report, INSURER’S DOCUMENTS, 2 liver specialists reports’ from 2 Singapore hospitals before I typed my argument in an A4 paper.

Like · Reply · 2 · Yesterday at 12:40am

Skong Wong

Write a reply…

Choose File

Simon Poon

Simon Poon Insult for the heath care industry and basic human rights.

Like · Reply · 18 hrs · Edited

Thanks for all the insurance forum members for all the valuable comments.